The Supreme Court has observed that Leave Travel Concession (LTC) is not for foreign travel and is meant for travel within India.

The moment employees undertake travel with a foreign leg, it is not a travel within India and hence not covered under the provisions of Section 10(5) of the Income Tax Act.

The court dismissed the appeal filed by State Bank of India against the Delhi High Court judgment which held that the amount received by the SBI employees towards their LTC claims is not liable for the exemption as these employees had visited foreign. The Revenue had held SBI to be an “assessee in default”, for not deducting the tax at source of its employees.

Section 10(5) of the Income Tax Act exempts from the ‘total income’ the payments received as LTC. Clause (5) reads as follos : In the case of an individual, the value of any travel concession or assistance received by, or due to him,— (a) from his employer for himself and his family, in connection with his proceeding on leave to any place in India.

In appeal, the SBI admitted that the travel made by its employees under LTC did involve a foreign leg and admittedly a circuitous route as opposed to the shortest route was taken. But it was pointed out that (1) the employees did travel from one designated place in India to another place within India (though in their travel itinerary a foreign country was also involved), and (2) the payments which were actually made to these employees was for the shortest route of their travel between two designated places within India. In other words, no payment was made for foreign travel though a foreign leg was a part of the itinerary undertaken by these employees.

The bench rejected both these contentions and made the following observations:

LTC is for travel within India, from one place in India to another place in India

“The contention of the Appellant that there is no specific bar under Section 10(5) for a foreign travel and therefore a foreign journey can be availed as long as the starting and destination points remain within India is also without merits. LTC is for travel within India, from one place in India to another place in India. There should be no ambiguity on this… The second argument urged by the appellant that payments made to these employees was of the shortest route of their actual travel cannot be accepted either. It has already been clarified above, that in view of the provisions of the Act, the moment employees undertake travel with a foreign leg, it is not a travel within India and hence not covered under the provisions of Section 10(5) of the Act.

A foreign travel also frustrates the basic purpose of LTC.

A foreign travel also frustrates the basic purpose of LTC. The basic objective of the LTC scheme was to familiarise a civil servant or a Government employee to gain some perspective of Indian culture by traveling in this vast country. It is for this reason that the 6th Pay Commission rejected the demand of paying cash compensation in lieu of LTC and also rejected the demand of foreign travel…There was no intention of legislature to allow the employees to travel abroad in the garb of LTC available by virtue of Section 10(5) of the Act. Therefore, the Revenue has a valid objection (apart from other objections which are clearly violative of the Statute), that the intention and purpose of the scheme is also violated in the garb of tour within India, foreign travel is being availed.

Employer cannot claim ignorance about the travel plans of its employees

The court observed that SBI cannot claim ignorance about the travel plans of its employees as during settlement of LTC Bills the complete facts are available before the assessee about the details of their employees’ travels.

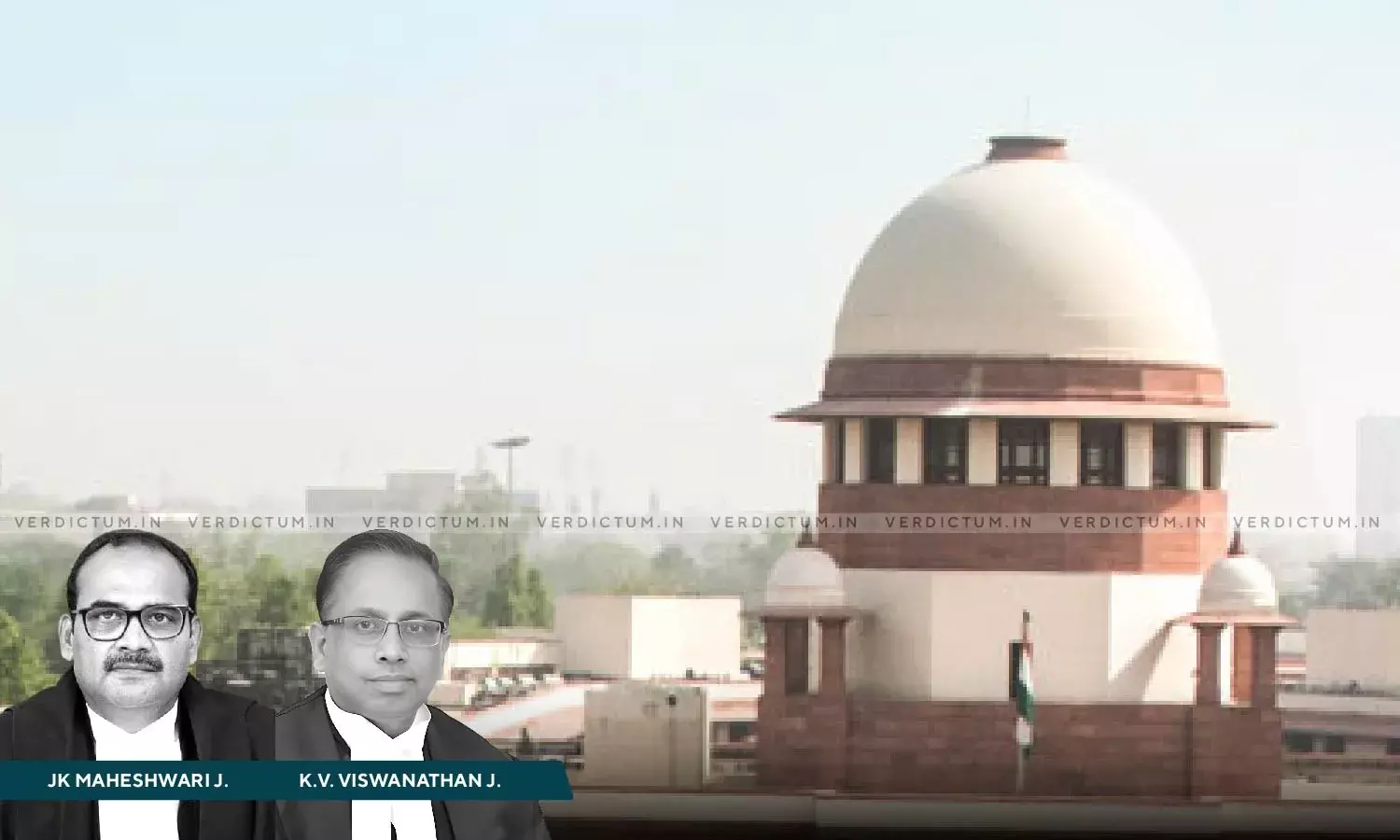

“Therefore, it cannot be a case of bonafide mistake, as all the relevant facts were before the Assessee employer and he was therefore fully in a position to calculate the ‘estimated income’ of its employees. The contention of Shri K.V. Vishwanathan, learned senior advocate that there may be a bonafide mistake by the assessee-employer in calculating the ‘estimated income’ cannot be accepted since all the relevant documents and material were before the assessee- employer at the relevant time and the assessee employer therefore ought to have applied his mind and deducted tax at source as it was his statutory duty, under Section 192(1) of the Act.”, the court added.

The court noted that many of the employees had undertaken travel to Port Blair via Malaysia, Singapore or Port Blair via Bangkok, Malaysia or Rameswaram via Mauritius or Madurai via Dubai, Thailand and Port Blair via Europe etc.

It is very difficult to appreciate as to how the appellant who is the assessee-employer could have failed to take into account this aspect. This was the elephant in the room, the court said.

Case details

State Bank of India vs Assistant Commissioner of Income Tax | 2022 LiveLaw (SC) 917 | CA 8181 OF 2022 | 4 November 2022 | CJI UU Lalit, Justices Ravindra Bhat and Sudhanshu Dhulia

Headnotes

Income Tax Act, 1961 ; Section 10(5) , 192(1) – Income Tax Rules, 1962 ; Rule 2B – Appeal against Delhi HC Judgment holding that amount received by SBI employees towards their Leave Travel Concession (LTC) claims is not liable for the exemption as these employees had visited foreign countries which is not permissible under the law – Dismissed – LTC is not for foreign travel – The travel must be done from one designated place in India to another designated place within India – The moment employees undertake travel with a foreign leg, it is not a travel within India and hence not covered under the provisions of Section 10(5) – Employer cannot claim ignorance about the travel plans of its employees as during settlement of LTC Bills the complete facts are available before the assessee about the details of their employees’ travels. Therefore, it cannot be a case of bonafide mistake.

Click here to Read full Judgment

Page Source : Live Law